What Is a Contactless Payment?

When did you last reach for your wallet to pay for something? Chances are, it wasn’t that long ago. But that could all be changing soon.

Welcome to the world of contactless payments – the new way to pay for goods and services without taking out your wallet or touching a card reader. Payments are made through an app or device, like a smartphone or smartwatch.

It’s a fast and easy method of payment that’s becoming increasingly popular in countries around the world. If you’re curious about what contactless payments are and how they work, this article is for you! We’ll dive into what contactless payment is, discuss adoption and usage trends, and more.

Table of contents

Overview of Contactless Payments

Thanks to contactless payments, you don’t need to carry cash or wait in line at a register when shopping. Instead, you can make quick and secure payments for goods and services with just a wave of your card or phone.

So what exactly is a contactless payment? A contactless payment is an electronic transaction that uses a device, like a debit or credit card, smartphone, or wearable device, to complete the transaction without having to make physical contact with a point of sale terminal. The payment is made through near-field communication (NFC) technology with the help of radio frequency identification (RFID) technology. In other words, your device communicates to the terminal via short-range wireless technology.

The convenience of contactless payments is one key factor driving their adoption. No more waiting in long lines at the checkout—transactions are faster and smoother than ever before when using contactless payments. Plus, they are incredibly secure and safe: each transaction requires authentication through biometric identification like fingerprints or facial recognition software.

With the advent of mobile wallets like Apple Pay and Google Pay making it easier than ever to make purchases on-the-go, more and more people are turning to contactless payments every day—especially since merchants worldwide have begun accepting them as an option at point of sale terminals.

Technology Behind Contactless Payments

How do contactless payments work? It’s a surprisingly simple process, but it requires two key technological components: near-field communication (NFC) and radio frequency identification (RFID).

Must-read: RFID Retail Benefits: A Guide For 2023

NFC is a short-range wireless technology that signals a specific action—in this case, sending payment information to the payment terminal. To initiate the purchase, you only need to hold your card or device close to the reader and wait for it to be approved.

RFID technology is then used to complete the transaction by transferring data back and forth between the card or device and the reader with a unique authentication code. This code verifies that it’s you purchasing by recognizing only authorized cards or devices. Once approved, you’re good to go.

Benefits of Contactless Payments

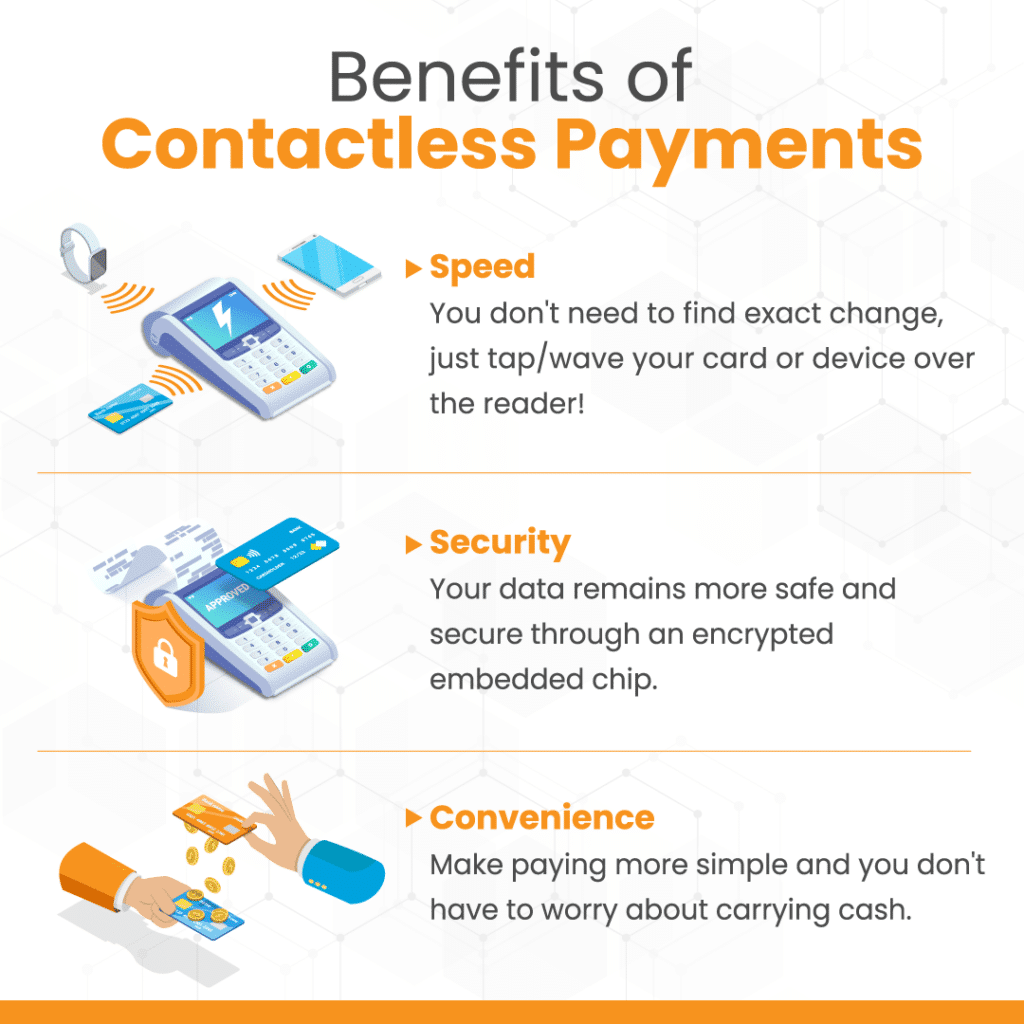

Why bother with contactless payments? Contactless payments let you pay quickly and securely without exchanging cash or a card. Plus, contactless payments work with most credit and debit cards. Here are some benefits:

Speed

With contactless payments, there’s no need to fumble around for change or type in passwords – it’s quick, convenient, and all you need is your card or device. All you have to do is tap your card on the reader or wave it over the reader, and you’re done!

Security

Contactless payments are more secure than cash because every card has an embedded chip that gets encrypted when tapped against the reader. The data can never be stored on the reader itself, so your data remains safe and secure.

Convenience

No more worrying about carrying cash and waiting in long lines at significant events. Contactless payment systems help reduce the time spent waiting in line or buying tickets. This makes everyone’s experience smoother and overall more enjoyable. They also help keep lines moving quickly at a retail store since the credit card machine can process these payments much faster than traditional credit card payments.

Adoption and Trends in Contactless Payments

You might be wondering why contactless payments are growing in popularity and what the adoption and usage trends are. The answer is simple: convenience. We live in a fast-paced world, so making on-the-go payments without inputting a PIN or signing receipts is super attractive.

Adoption of Contactless Payments

According to Fintech Features, the global contactless payments market is estimated to reach $90.6 billion by 2032 from $22.4 billion in 2022 and is expected to grow at a CAGR of 15.4% during the forecast period from 2023 to 2032. This growth is primarily due to how safe contactless payments are (using secure encryption). Plus, there’s no need to carry cash and risk losing it.

Tap-and-pay technology has dramatically increased over the past year as more consumers switch to digital wallets and payment apps like Apple Pay and Google Pay. Consumers are looking for a more seamless and quick checkout. And contactless payment meets this demand.

Emerging Trends in Contactless Payment Technology

Contactless payment technology has grown rapidly over the last few years, thanks largely to mobile wallets becoming mainstream.

To meet customer demand for faster payments, many merchants have adopted newer technologies, like Bluetooth-enabled devices, which allow customers to quickly make payments without opening their phones or wallets. Additionally, many banks have begun using biometric authentication methods (such as fingerprint scanning) for added security when making contactless payments.

This technology is also collecting momentum as its cost continues to decrease, thanks to improvements in manufacturing processes. In addition, more retailers are embracing this trend by integrating it with their existing POS systems.

Security Concerns of Contactless Payments

You might wonder, “Aren’t contactless payments more vulnerable to fraud?” The truth is that contactless payments are just as secure as using a physical card. With a contactless card, you have the same layers of security and fraud protection as when purchasing with a physical card.

The payment networks, such as Visa and MasterCard, use advanced security measures to prevent fraud and protect your personal information:

- Every transaction is authorized by your PIN or signature.

- The payment provider checks the identity of the person attempting to make the purchase via facial recognition or other biometric technology.

- If there is any suspicious activity, your bank can decline the transaction, issue an alert, and block it.

- Visa and MasterCard also provide zero liability protection for any unauthorized transactions made with their cards.

These security features make contactless payments just as safe (if not safer) than using cash or physical cards for payment.

Preparing for Contactless Payments

What if you want to adopt contactless payments? For those already switching to contactless payments, a few steps should be taken first.

Hardware and Software

You’ll first need hardware and software that can handle contactless payments. This includes POS systems, point of sale devices, and mobile payment processors. You’ll also need to ensure that your technology supports NFC, which securely exchanges payment information between a device and a reader.

Security

Security is paramount when it comes to contactless payments, so ensure you have the right security protocols in place. This includes using secure data encryption for customer payment data and tokenization to protect customers’ sensitive information. It’s also essential to have an up-to-date anti-fraud protection system in place.

Adoption Plan

Finally, you need an adoption plan — how will you get customers on board with contactless payments? This could include making sure they understand how it works and how it keeps their personal data safe or even offering discounts or rewards for customers who make contactless payments. Whatever your plan may be, having one in place is essential before implementing a new system like this.

How Can POS System Facilitate Contactless Payments

You may be wondering how merchants can accept contactless payments.

The answer lies in your point of sale (POS) system. This is the system that helps a business manage its sales and customer information, as well as process payments. You need a POS system that supports contactless payments. This usually comes in the form of an integrated card reader or tap-and-go terminal.

The merchant can set up wireless readers at checkout or accept customers’ mobile wallets, like Apple Pay and Google Pay. When it’s time to pay, customers simply hold their device or card up to the card reader for a few seconds—it’s that easy! Transactions are processed quickly and securely, making them more convenient for merchants and customers.

In addition to being more convenient for customers, POS systems that facilitate contactless payments have seen increases in average transaction value of 82%. This means more customer satisfaction and higher revenue potential for merchants.

Conclusion

In conclusion, contactless payments are a secure, convenient, and increasingly popular way to pay for goods and services. With faster processing times and improved fraud protection, contactless payments present an ideal way to manage money on-the-go. Contactless payments are growing, and it’s easy to see why. As more and more consumers switch to using contactless payments, we’ll likely see more widespread adoption and a continuing trend in growth.

.jpg)